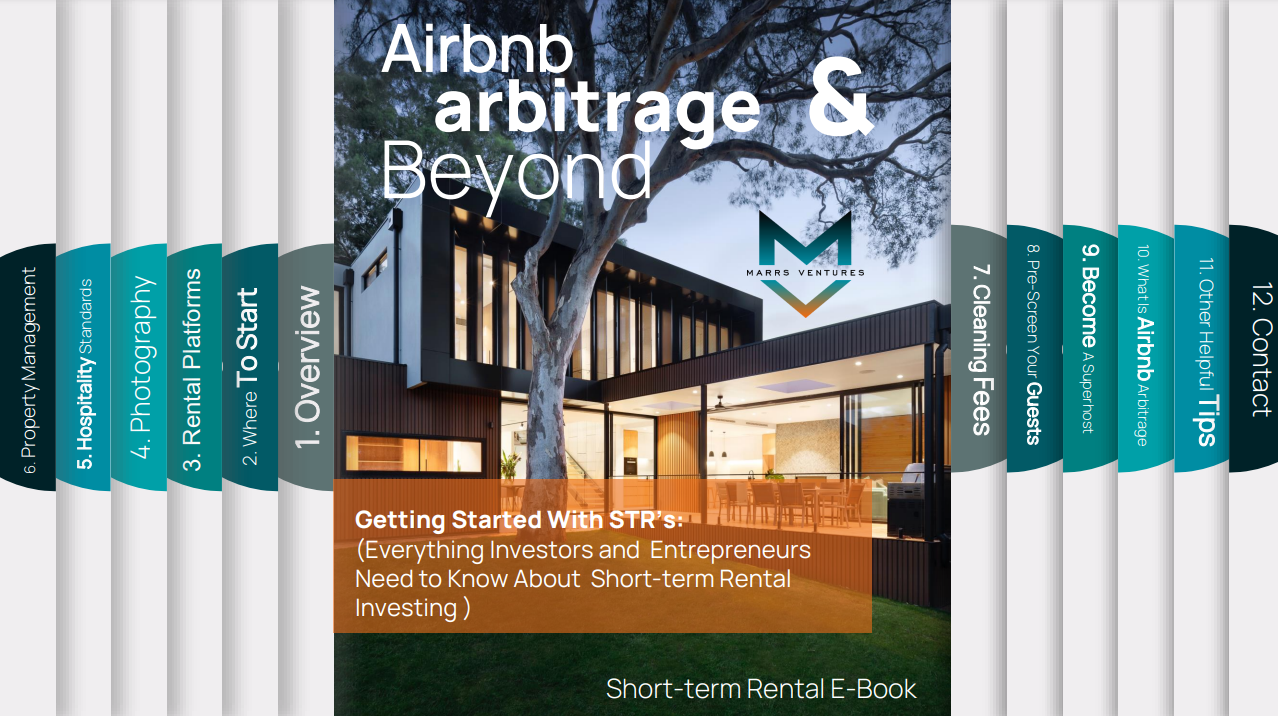

Venturing Into Short-Term Rentals Without Acquiring Real Estate Property

Are you interested in venturing into short-term and/or corporate rentals but find yourself lacking the necessary cash and credit to acquire real estate properties? Look no further! Introducing "Getting Started with Short-Term Rental Investing," the ultimate guide to unlocking the secrets of short-term and corporate rental arbitrage—the revolutionary real estate hack of today.

About the Author

Kevin Mitchell

A seasoned investor and startup co-founder, this ebook is tailored for both experienced real estate enthusiasts and newcomers alike. Kevin demystifies the arbitrage model and reveals how anyone, regardless of their level of experience, can be successful in this endeavor.

Inside this comprehensive guide, you will discover:

Understanding the Rental Arbitrage Model

Gain a clear understanding of how rental arbitrage works and how it can be leveraged to generate substantial income. Kevin Mitchell explains the intricacies of this model in a simple and concise manner, making it accessible to beginners.

Pitfalls to Avoid

Avoid common mistakes and pitfalls that can hinder your progress in the rental arbitrage journey. Kevin Mitchell shares his expertise and provides valuable insights on what to watch out for, allowing you to navigate the market with confidence and make informed decisions.

Effective Strategies for Financial Success

Learn proven strategies to maximize your profits and achieve financial success in the short-term rental market. Explore various techniques and approaches that will help you generate significant cash flow and high yield returns.

Resource List of Supporting Corporations

Access a curated list that you can use as an excellent resource for short-term and corporate rental investors. These trusted partners can provide valuable guidance, support, and services to help you achieve long-lasting success in your rental business.

15% IRR Verbiage

At Marrs Ventures, we understand that traditional property ownership can be daunting and resource-intensive, limiting the potential for financial growth. That's why we present an innovative solution that allows you to partake in the lucrative realm of short-term rentals with ease and confidence.

With a steadfast commitment to delivering unparalleled results, we empower you to seize the immense opportunities offered by short-term real estate, all while reaping the benefits of an impressive 15% IRR.

Embrace a new era of investing, where your financial aspirations transcend the barriers of conventional property acquisition, and venture towards a brighter, more prosperous tomorrow with us by your side.

Download our 2023 Ultimate Guide on Short-Term Rental Investing now!

Testimonials

Our Clients Support Our Work

Sustaining Through Client Partnerships

Naysayers love uttering defeatist statements like, “In this economy, it’s impossible to increase your income!” Guess what, naysayers: Here’s an example of one

side gig that grosses more than my former salary, while occupying only a few hours per month. A little bit of hustle goes a long way.

Paula Pant

Airbnb arbitrage is an absolute game changer in the real estate space. To be able to work with an entity to solve the biggest challenge in this otherwise lucrative market, procuring homes/units, creates unlimited upside for both parties. With arbitrage I’ve been able to 3x my ROI.

Misty Metcalf

In regards to creating extra income with

short-term rentals, here’s a quote from Sally: “I wrote our Airbnb listing to appeal to families — emphasizing the backyard, safe neighborhood, kids’ toys and equipment.” She listed the entire house for $500 a night and frequently rented out the entire home for a week in the summer while her family was on vacation for over $3,000 per month.

Sally Miller

Frequently Asked Questions

What is the minimum investment amount?

$50,000 USD

Do I need to be an accredited investor to participate in the fund?

Yes. More information on what qualifies is available here

What types of properties are you purchasing?

The properties we acquire will range in location, style, theme, and amenities to keep us diversified but generally will have an upscale and modern feel.

How are the properties insured?

During the due diligence process each property undergoes thorough risk evaluation; policies are issued based on this analysis to protect the assets against potential risks. These policies range from general homeowner insurance, commercial property insurance, landlord insurance, flood insurance, vacation rental insurance, and umbrella insurance.

How long does it take for a property to become?

The combination of Marrs Ventures’ business model and acquisition strategy allows properties to be fully optimized in significantly quicker than traditional hosts. In most cases, we expect rentals to be optimized within 180 days of closing.

When can investors expect distributions?

Properties are purchased in two million dollar tranches. Distributions are conservatively expected to be made within the 180 grace period to get the short-term rental units furnished and optimized.

Take the first step towards financial freedom